Contracts for Difference (CFDs) are a popular financial product that allows traders to speculate on price movements in various markets such as stocks, commodities, and currencies, without actually owning the underlying asset. CFD trading can be lucrative but is also associated with high risk. To be a successful CFD trader, one needs to have an effective risk management plan that helps to minimize potential losses. In this blog post, we will discuss some risk management strategies for successful CFD trading.

Set Stop Loss and Take Profit Orders: One of the most common and effective risk management strategies for CFD trading is setting stop loss and take profit orders. Stop loss is an order to sell or buy a certain CFD asset when it reaches a specified price level to limit potential losses. Similarly, take profit is an order to sell or buy an asset when it reaches a pre-defined price level to lock in profits. By setting these orders, traders can limit their losses and profits to a specific price range.

Monitor the News and Economic Indicators: CFD traders should keep an eye on economic indicators and news events that could impact the price of the underlying asset. By staying informed, traders can make informed decisions and update their positions accordingly to minimize potential losses. For example, if a positive economic indicator is released, traders may want to go long on an asset, while negative news could trigger a short position.

Use Leverage Wisely: CFDs are highly leveraged products, which means that traders can control a large position with a small amount of capital. While leverage can amplify profits, it can also increase potential losses. Therefore, traders must use leverage wisely and never overextend themselves.

Diversify the Portfolio: Another effective risk management technique is diversifying the trading portfolio. By spreading risk across different assets, traders can minimize potential losses if one trade goes against them. Diversification can be achieved by trading across different markets or using CFDs that track multiple assets.

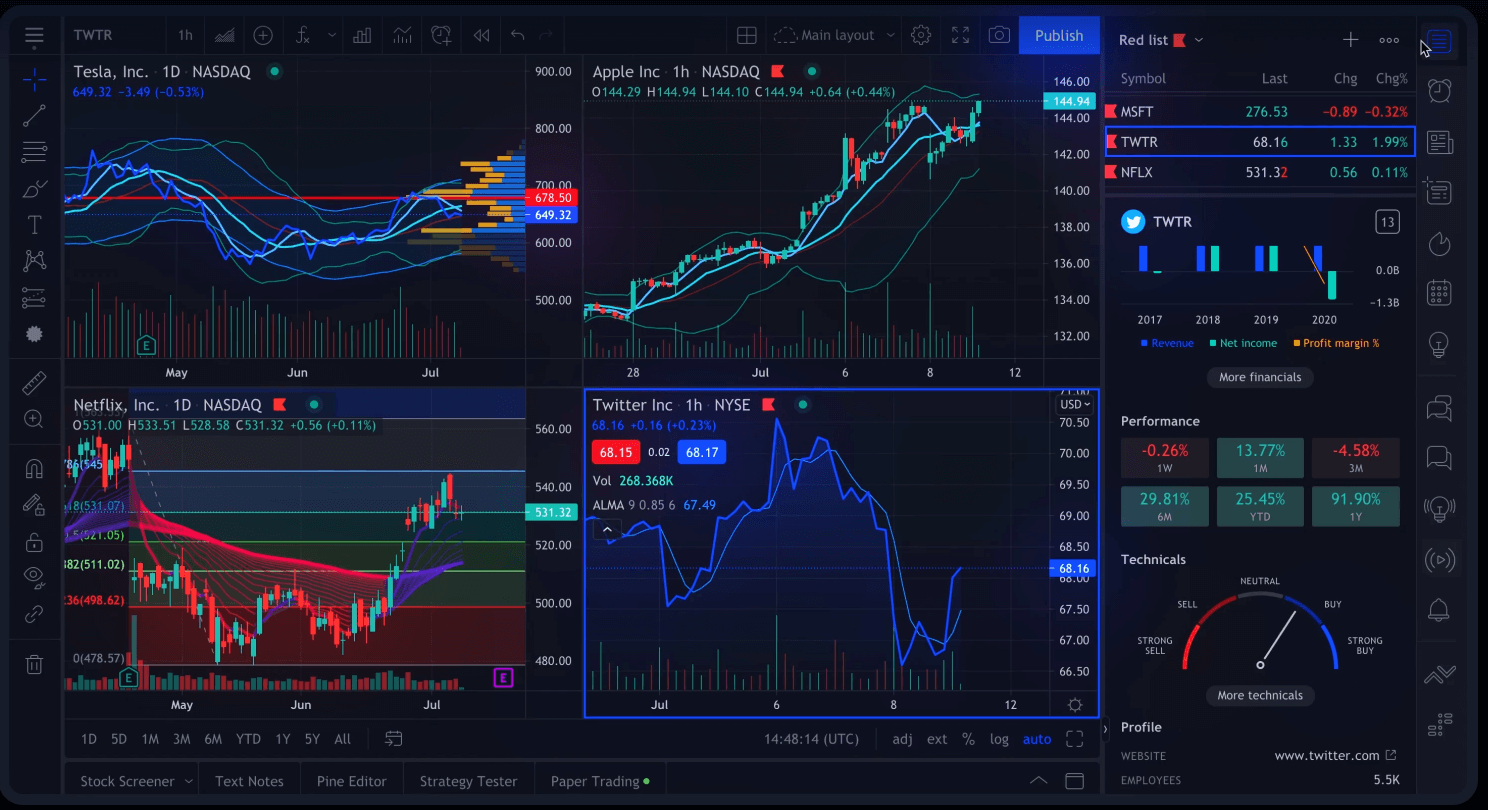

Use Technical Analysis: Technical analysis involves analyzing price charts and identifying patterns to forecast future price movements. By using technical analysis tools, traders can spot trends and potential price movements, allowing them to make informed decisions and reduce potential losses.

Conclusion:

cfd trading can be a profitable but high-risk activity, and traders must have effective risk management strategies in place to minimize potential losses. By setting stop loss and take profit orders, monitoring news and economic indicators, using leverage wisely, diversifying the portfolio, and using technical analysis, traders can manage their risks and increase their chances of success in the market. Remember that risk management is an ongoing process, and traders should always adapt their strategies to changing market conditions.